Enhancing financial workflows through innovative technology

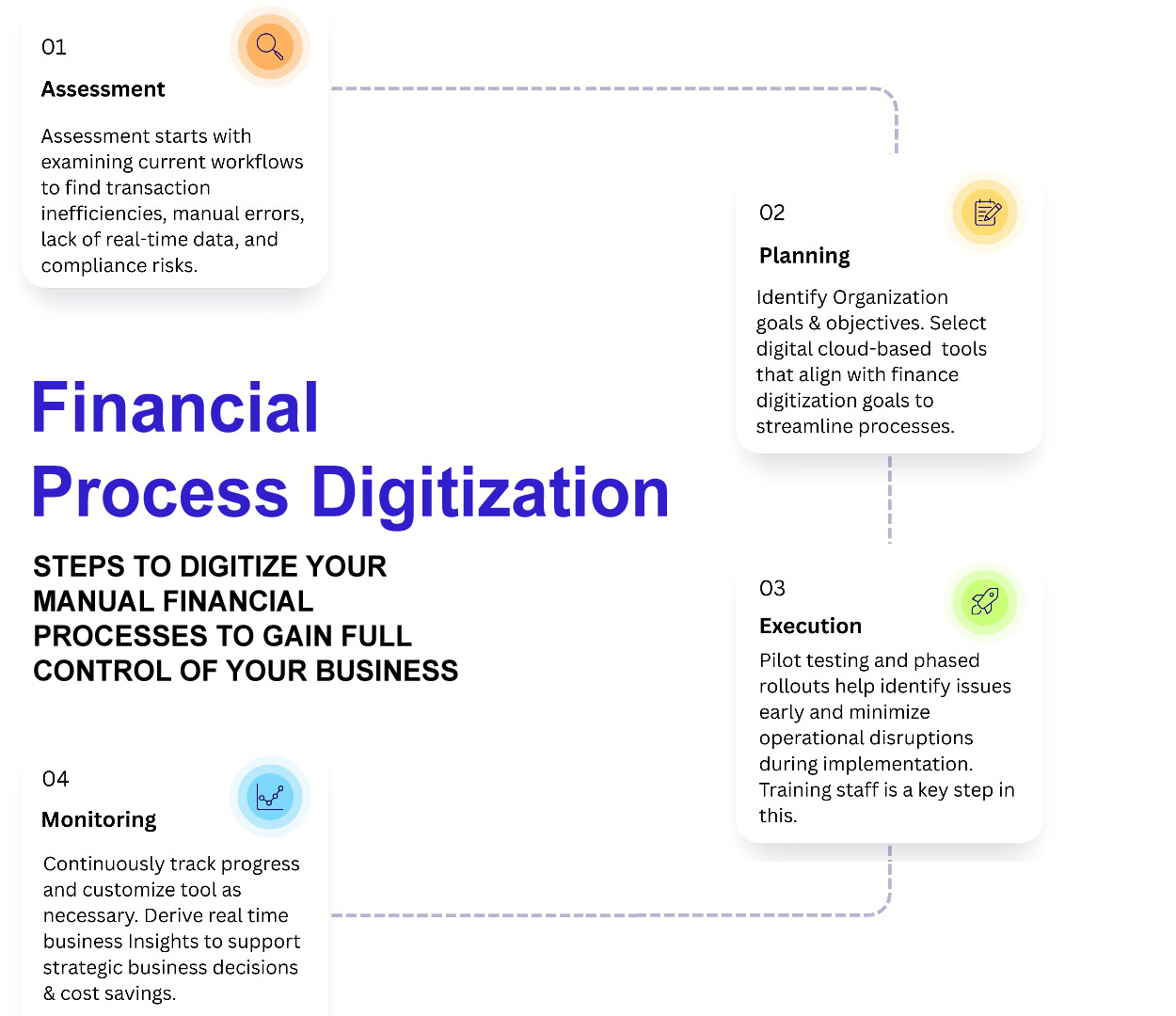

Finance process digitisation refers to the transformation of traditional, paper-based, and manual financial workflows into streamlined, technology-driven processes. At its core, it involves automating routine activities such as invoicing, accounts payable and receivable, expense management, payroll, compliance reporting, and financial reconciliations through digital tools and platforms. By adopting technologies like enterprise resource planning (ERP) systems, cloud-based accounting software, robotic process automation (RPA), and AI-powered analytics, organizations can eliminate inefficiencies, reduce errors, and improve transparency. A digitised finance process enables real-time data capture and reporting, which enhances decision-making and supports better cash flow management. It also improves compliance by ensuring audit trails and regulatory accuracy while strengthening data security. Beyond efficiency, digitisation allows finance teams to shift focus from transactional tasks to strategic roles such as financial planning, forecasting, and performance analysis. Ultimately, the basics of finance process digitisation are about replacing manual, repetitive processes with intelligent, automated solutions that improve accuracy, speed, scalability, and strategic value for the business.

eTCR

Customised software serving as a handy tool for all service engineers

Zoho Implementation

We offer Zoho Implementation and customisation as per your specific business needs

Other business accounting tools supported